Determine Your Monthly Net Income

This is easy!

If you work 20 hours per month at $8 an hour, your monthly

income is $160 per month. Or is it? Remember, you have to pay taxes

or for your portion of any company-sponsored benefits, like health

insurance or a 401(k). Those costs come out of your paycheck before

you ever see it. So, take this into consideration to determine what

money you can count on actually coming in every paycheck - also

known as your net income.

It's important to avoid counting overtime or other potential

income of which you are not certain. If these funds come in, you

can adjust. However, for the sake of realistic planning, it's smart

to only count income you know you will receive.

It's important to double-check this calculation of your monthly

net income regularly to ensure it is always up to date.

At this point, it's a good idea to get all of your paperwork

organized. Find a folder, a drawer or even a digital file to make

your Money Management file. You will always have what you need to

easily review your resources and your goals. Begin this simple

process now.

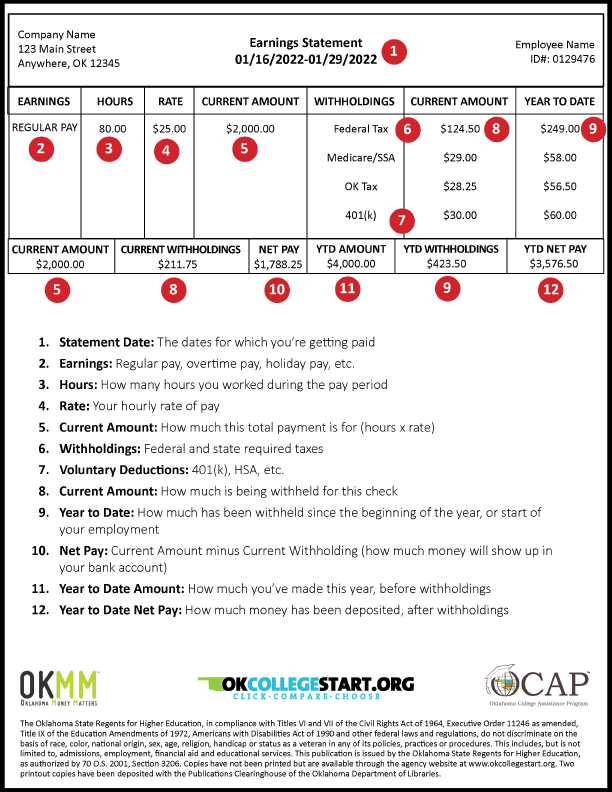

Check out this sample pay stub to learn more about earnings,

withholdings and deductions you may see on your pay stub.

Visit OklahomaMoneyMatters.org to

learn more about financial fitness.